- Cleantech investors join Automotive EV leaders in $150M Growth Funding

- Strategic investors using GaN to build electrification platforms delivering breakthrough levels of power efficiency

OTTAWA, Canada – GaN Systems, the global leader in GaN (gallium nitride) power semiconductors, today announced its growing ecosystem of partners collaborating to address the Net Zero Challenge to neutralize emissions of carbon dioxide (CO2) and other greenhouse gases by accelerating the global sustainability and cleantech revolution.

Efficient power generation, distribution and conversion are key factors in driving sustainability and reducing emissions. Since GaN is inherently more efficient than Silicon and Silicon Carbide, any power conversion equipment maker designing with GaN contributes to a greener planet. The highest paybacks come from implementing GaN at the biggest sources and uses of power. Factory and industrial motors are one of the biggest users of electricity. With GaN in their motor drives, Siemens is, “now able to increase the efficiency of the drives,” says Christian Neugebauer, Siemens’ product manager for the Micro-Drives. “With GaN, Siemens can switch to a higher frequency, thereby enabling a faster motor response time compared with high-voltage drive systems.” And, as we all use more data in our video-watching, picture-sharing, online gaming and music-streaming, GaN is implemented in more and more power supplies in the data centers, reducing power losses by 50% and increasing power densities.

In power generation, Enphase Energy recognizes the importance of GaN for inverter design with higher efficiency and 50% increase in power density. In addition to ensuring the source power is clean, Enphase is also reducing consumption of scarce natural resources. With GaN’s ability to operate power systems at higher powers and in smaller sizes, use of copper, plastic and other materials is greatly reduced.

In consumer devices, GaN Systems partners are also making step-function improvements in efficiency and using less materials in their products. Dell and Harman are taking the lead here. Not only did Harman reduce the size of its chargers and use less material in their manufacturing, Harman took the extra step of using 90% recycled plastic in its products.

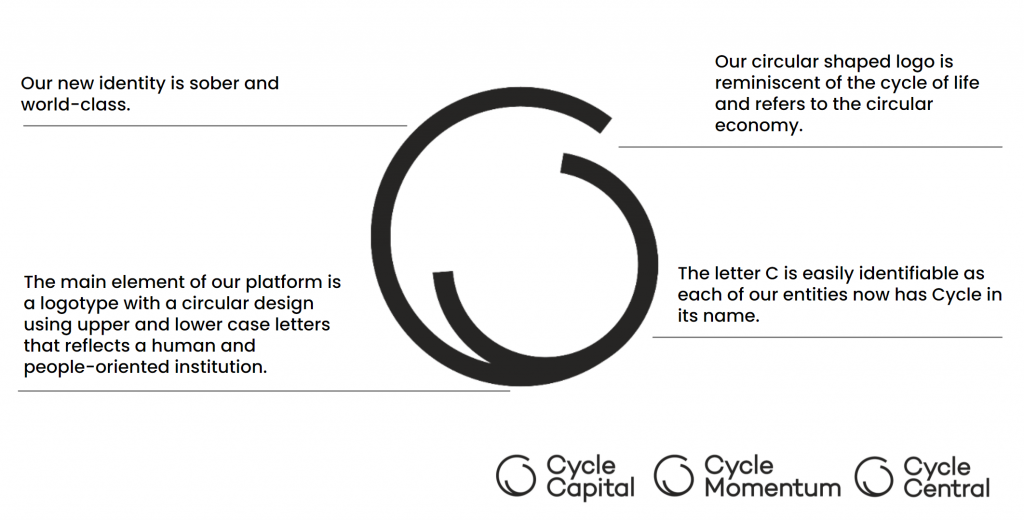

Investors see GaN technology as an essential weapon in the fight against climate change. Long-time investors in GaN Systems who participated in the $150 million growth round and who are also leaders in Cleantech include Business Development Bank of Canada (BDC), Cycle Capital, Export Development Canada (EDC) and BMW iVentures. New investors in the round include Fidelity Management & Research Company LLC, who led the round, as well as USI, Vitesco Technologies, Dockyard Capital Management, GSR, and HG Semiconductors.

“As a long-time investor in GaN Systems, we have always seen the potential for GaN to empower customers to deliver on the Net Zero promise,” said Andrée-Lise Méthot, Founder and Managing Partner of Cycle Capital. “We have been particularly impressed with the company’s leadership in reliability and efficiency, which is evidenced in industry leaders choosing GaN Systems for their next generation power needs. We will continue to support the company as it delivers on its mission and look forward to seeing continued positive impact on sustainability from GaN’s continued success.”

“Interest in the round was strong from the beginning,” said Chris Zegarelli, CFO of GaN Systems. “We saw a range of investors, from strategic partners looking to deepen long-standing relationships to new investors recognizing our technology leadership and seeing the inherent sustainability benefits of GaN.”

“GaN Systems’ gallium-nitride semiconductors represent a key enabling technology for the clean energy transition. GaN brings about important efficiency and performance gains in electric vehicles and renewable energy systems. This technology will also help to significantly reduce energy consumption in data centers and in millions of consumer electronic devices,” said Zoltan Tompa, Managing Director of BDC Capital’s Cleantech Practice. “As a long-time investor in GaN Systems, BDC Capital is pleased to increase its support for this high impact Canadian clean technology company.”

Jim Witham, CEO at GaN Systems, said, “We saw strong interest and support from strategic partners in this round. Our collaboration with Vitesco and USI will enhance our leadership in GaN for electric vehicles. Our partnership with GSR will enable us to drive growth in China across multiple target markets. These partnerships build on long-standing collaboration with BMW, Toyota, Siemens and others to continue to drive momentum in GaN across our target markets. We at GaN Systems are all looking forward to working with these great companies to proliferate GaN across automotive, consumer, enterprise and industrial markets.”

About GaN Systems

GaN Systems is the global leader in GaN power semiconductors with the most extensive transistors portfolio that uniquely addresses the needs of today’s most demanding industries, including consumer electronics, data center servers, and power supplies, renewable energy systems, industrial motors, and automotive electronics. As an industry-leading innovator, GaN Systems makes it possible to design smaller, lower cost, more efficient power systems. The company’s award-winning products provide system design opportunities free from the limitations of yesterday’s silicon. By changing the transistor performance rules, GaN Systems enables power conversion companies to revolutionize their industries and transform the world. For more information, please visit: www.gansystems.com or on Facebook, Twitter and LinkedIn and scan this QR code for our WeChat.

Media Contact:

Mary Placido

Trier and Company for GaN Systems

Email: [email protected]