VANCOUVER, BC, Canada, May 12, 2021 – Encycle Corporation, a software technology company focused on helping commercial and industrial customers dramatically improve the efficiency of their HVAC systems using artificial intelligence-based services, is pleased to announce that it has closed a $7.5 million financing round from a group of advanced energy investors led by Cycle Capital.

Encycle’s unique HVAC energy management technology, Swarm Logic®, is empowering some of the biggest retailers and other multi-site companies to combat HVAC-related energy challenges. The data-driven, multi-patented technology significantly reduces customers’ electricity usage and carbon emissions, helping meet corporate sustainability targets. Swarm Logic has drawn broad interest from companies strategically involved in green investing. Among Encycle’s most recent investors are Turntide Technologies®, a developer and manufacturer of the Turntide Smart Motor SystemTM and Active Impact Investments, a venture capital firm focused on clean tech.

Statements

“We are excited by Encycle’s unique ability to autonomously monitor and control HVAC equipment to drive savings. Not only does Swarm Logic drive down energy costs but it also reduces GHG emissions significantly for commercial and industrial customers. As a cleantech investor, we choose to work with companies that have a meaningful impact on climate change and we believe that Encycle’s experienced and proven management team in combination with the fact they have established commercial partnerships with top tier building automation system players will allow the company to rapidly scale their solution.” says Andrée-Lise Méthot, Founder and Managing Partner of Cycle Capital.

“When evaluating Encycle’s investment potential, it became clear there were tremendous synergies between their Swarm Logic technology and our Platform for Sustainable Operations,” said Ryan Morris, Chairman and CEO of Turntide Technologies. “Both companies’ technologies focus on reducing energy waste for a more sustainable tomorrow, and combining our offerings provides customers with the most compelling HVAC optimization solution on the market,” Morris explained. “Together with Encycle, we can provide industry leaders with new sets of energy-efficiency capabilities that align with their business and sustainability goals.”

“We’re thrilled to be partnering with Bob and the Encycle team,” said Mike Winterfield, Managing Partner of Active Impact Investments. “They have the grit, depth and history of value creation to capitalize on the opportunity created by growing customer demand for optimized HVAC while doing the right thing for the planet. Encycle’s turnkey software solution makes for a seamless and efficient customer adoption experience that positions them well to maximize impact and growth in an increasingly competitive space. Encycle’s solution is an excellent fit for Active Impact’s portfolio since it delivers the optimal mix of cost savings and environmental benefit, and it’s the ideal time to scale.”

Robert Chiste, Encycle’s Chairman and CEO, stated, “We are very pleased that Cycle Capital has led our latest funding round joined by new investors Active Impact Investments and Turntide Technologies and existing investors Prelude Ventures, NGEN Partners, Enertech Capital, and Sorfina Capital.” Chiste continued: “This funding, combined with the added expertise and leadership from the new Board and Observer members, will support the extension of our artificial intelligence-based technology into new customer applications. Additionally, the funding will help accelerate the growth of our strategic partner program, which already includes industry leaders like Honeywell International, ENTOUCH, Lime Energy, Resideo, Carrier and Lightstat. As we continue to accelerate customer adoption of our cloud-based Swarm Logic technology through channel partners and direct sales efforts, Encycle remains committed to investing in modern tools such as AI and data science to continually increase efficiencies and value.”

Encycle developed Swarm Logic, a cloud-based technology that dynamically synchronizes HVAC rooftop units (RTU) control decisions, enabling RTUs to operate most efficiently by responding in real-time to changing conditions such as outdoor temperature and building occupancy levels. Swarm Logic uses artificial intelligence capabilities to create dynamic models for each building and its thermal load profile. With Swarm Logic, RTUs become part of an IoT-based closed-loop system that coordinates their activity and distributes energy consumption more logically among the individual RTUs without the need for additional hardware or equipment in most cases. The enterprise-wide solution, which has been awarded 18 patents to-date, operates quietly in the background, requiring no human interaction to maintain or monitor its actions. Deployed as a software-as-a-service (SaaS) solution, the company’s flagship technology typically saves customers 10%-20% on HVAC-related energy consumption, demand, and spend.

In the past couple of years, Encycle has helped its customers save over $10.5 million in energy costs and reduce CO2 emissions by nearly 60,000 tons. Swarm Logic has been deployed at over 1,000 sites with 10,000 RTUs, and is optimizing over 125 MW of customer electric load across North America.

Learn more about Encycle and the Swarm Logic energy management solution at encycle.com.

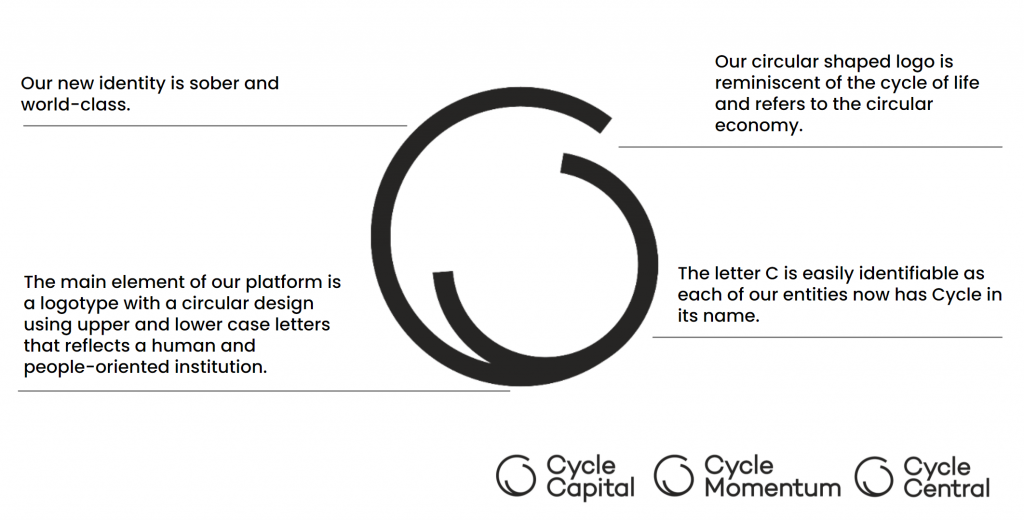

About Cycle Capital:

Cycle Capital is an impact investor and Canada’s leading private cleantech venture capital investment platform with AUM north of $500 million. With offices in Montreal, Toronto, and Qingdao – in continental China – and a presence in New York and Seattle, Cycle Capital invests in companies at the development and growth stages that commercialize clean technologies that reduce greenhouse gas emissions, optimize resource use, and improve process efficiency. Cycle Capital is the Founder of the Ecofuel Accelerator. For more info, visit www.cyclecapital.com .

About Active Impact Investments:

Active Impact Investments is a Certified B Corp based in Vancouver, BC, whose mission is to support environmental sustainability through profitable investment. With two limited partnership funds with over $50M in assets under management, the venture capital firm provides funds and talent to accelerate the growth of early-stage climate tech companies with $200K to $3M in revenue and significant growth potential. Active Impact’s portfolio includes and is seeking some of the most successful startups in North America that are capable of achieving venture scale and becoming extremely profitable while solving the most urgent environmental issues. For more information, visit activeimpactinvestments.com.

About Encycle:

Encycle is a technology-driven company that is transforming energy management for multi-site commercial and industrial companies. The company leverages the power of artificial intelligence in its patented cloud-based technology to lower its clients’ electric costs, maximize energy efficiency, and reduce environmental impact. Companies using Swarm Logic® routinely reduce HVAC electric costs and consumption by 10%-20% with little or no capital investment. For more information about Encycle, visit www.encycle.com or follow the company on LinkedIn.

About Turntide Technologies:

Headquartered in Sunnyvale, California, Turntide develops breakthrough sustainability technologies that drive down energy consumption and operating costs in buildings, agriculture, and electric transport, creating a path to 100% renewable energy and business sustainability. The Turntide Smart Motor System is part of an open Platform for Sustainable Operations, driven by a patented Turntide Optimal Efficiency Motor™ with intelligent automation and cloud connectivity. The Smart Motor System advances sustainability goals, saves money, and minimizes unexpected downtime. For more information, visit https://turntide.com/ or follow the company on YouTube, Twitter, and LinkedIn.

Information

Catherine Berube

Vice-President, Sustainable Development, Investor Relations and Public Affairs

cberube@cyclecapital.com